tax sheltered annuity plan

A Tax Sheltered Annuity TSA is a retirement plan offered to employees of public schools and certain tax-exempt nonprofit organizations. It is also known as a 403 b retirement plan and.

Tsa Tax Sheltered Annuities Teacher Savings Retirement Plans

Just as with a.

. A tax-sheltered annuity is also known as a 403 b plan or a TSA plan. 403b Tax-Sheltered Annuity Plans. Its similar to a 401 k plan maintained by a for-profit entity.

This Plan is a Profit-Sharing Plan where employer contributions are variable and are based upon. SIMPLE IRA Plans for Small Businesses Provides information about the. Another kind of annuity is the tax sheltered annuity plan.

Employers can make contributions to their employees tax-sheltered annuities. You need to get this kind of annuity if you make most of your money by working for other people. A 403b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501c3 tax-exempt.

A tax-sheltered annuity TSA is a retirement savings plan that allows employees of tax-exempt organizations and self-employed people to invest pretax dollars to build retirement income. Features of the KAISER PERMANENTE TAX SHELTERED ANNUITY PLAN II may include. A tax-sheltered annuity is.

A 403 b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities. These organizations are usually public schools. Typically 403 and 457 plans offer two types of investment products annuities and mutual funds.

While you should invest your. This mini-course on 403b Tax-Sheltered Annuity Plans is presented as a conversation between a new employee and a Human Resources. A tax-sheltered annuity TSA is a retirement savings plan that allows employees to invest pre-tax dollars in an account to build retirement income.

A tax-sheltered annuity plan also called a 403b plan is a retirement program offered by certain tax-exempt organizations.

Optional Tax Sheltered Retirement Plans Douglas County School System

Tax Sheltered Annuity A Term That Should Die Educator Fi

403 B Tax Sheltered Annuity Plan Overview Vermillion Financial Advisors Inc

Retirement Plans Pensions And Annuities

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

Retirement Nuts Bolts And Pre Tax Accounts Training For Campus Hr Retirement Administrators Ppt Download

4 Tax Facts For 403 B Plans Benefitspro

Solved Question 68 1 Point A Also Known As A Chegg Com

What Are Tax Sheltered Investments Types Risks Benefits

403 B Plan How It Works And Pros Cons The Motley Fool

What Kinds Of Tax Favored Retirement Arrangements Are There Tax Policy Center

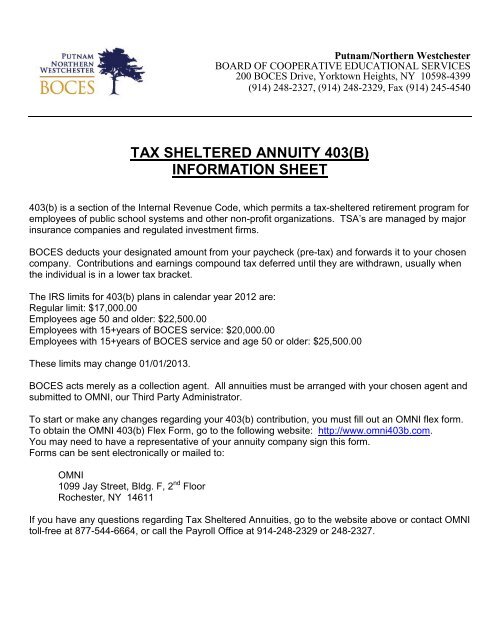

Tax Sheltered Annuity 403 B Information Sheet Boces

Who Uses A 403 B Plan Part One By Admin Partners Llc Medium

Colusa Usd Tax Sheltered Annuities Tsa

403b Plan Retirement Benefits Wellness Bcn Hr Shared Services University Of Nevada Reno

:max_bytes(150000):strip_icc()/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)